Biotech Take-Home

Predicting Phase 2 Clinical Trial Success & Orforglipron Launch

Agenda

Part 1 — DNTH Claseprubart

Predicting the likelihood of success of DNTH's claseprubart in MMN

- Rationale for selecting this program

- Core biological concepts

- The disease & the drug

- Key comparator trials

- Probability of success

Part 2 — Orforglipron

Modeling the launch of orforglipron

- Market context

- Population segmentation

- Penetration estimates

- Launch scenarios

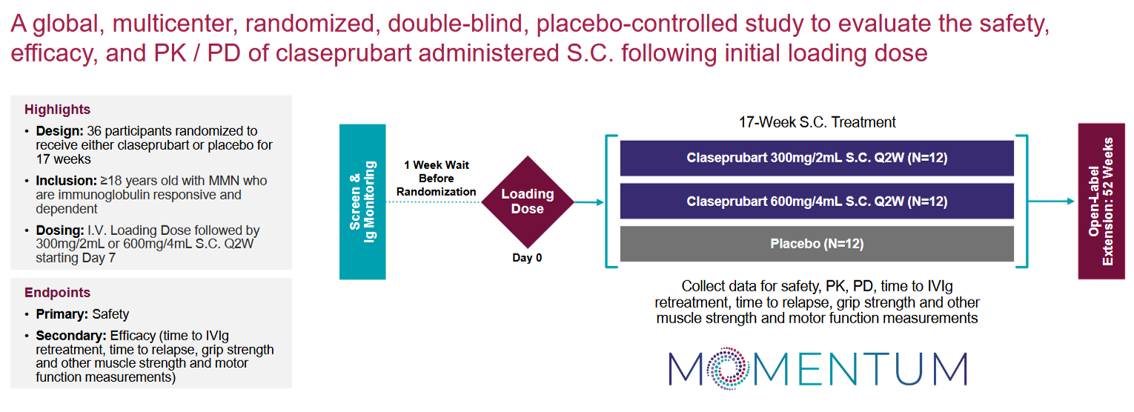

Claseprubart in MMN — The MOMENTUM Trial

Reading out in 2H26

The Punchline

The Drug

Safe and efficacious. We know it hits its target from the Phase 2 in Myasthenia Gravis.

The Science

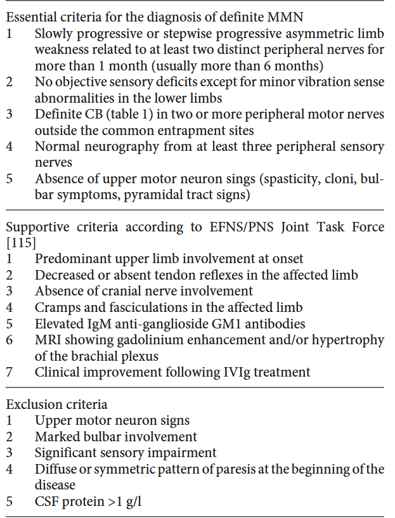

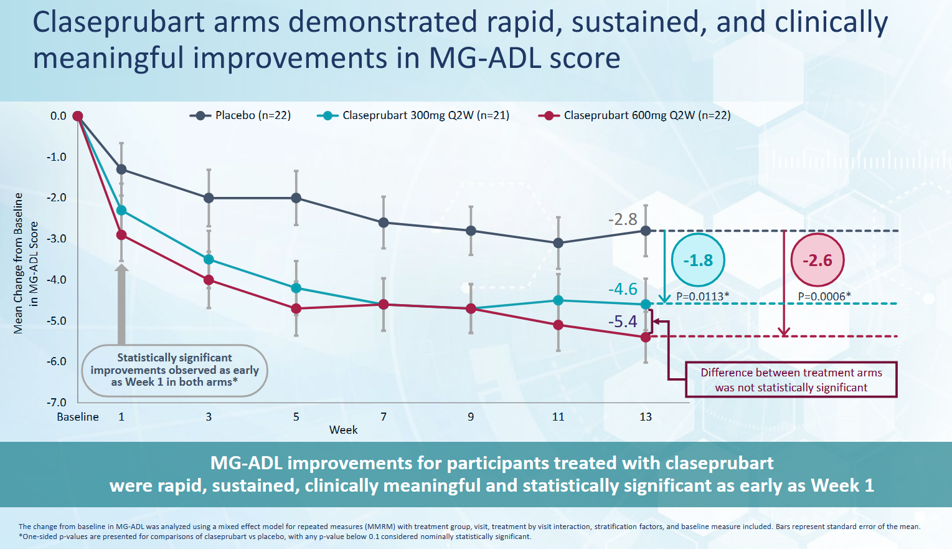

Positive Phase 2 results in MG demonstrate efficacy and safety, providing a foundation for expectations in MMN trials.

The Indication

Competitor ARGX's empasiprubart trial suggests that inhibiting the complement pathway works in this indication, and that placebo effects are manageable.

The Pathway

Successes and failures, but biological reason to believe this will succeed.

The Team

Management executing in MG with relevant pharma experience.

Rationale for Selecting This Trial

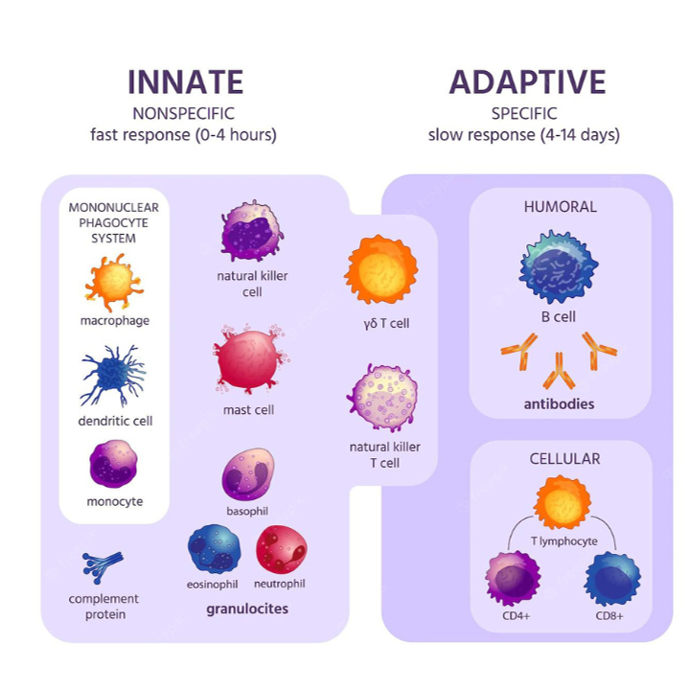

Innate vs Adaptive Immunity

The immune system has two arms: innate (fast, non-specific) and adaptive (slower, highly targeted). The complement system bridges both.

The Complement Cascade

A chain of protein activations (Classical, Lectin, Alternative pathways) that tags pathogens for destruction. Classical pathway starts with C1s.

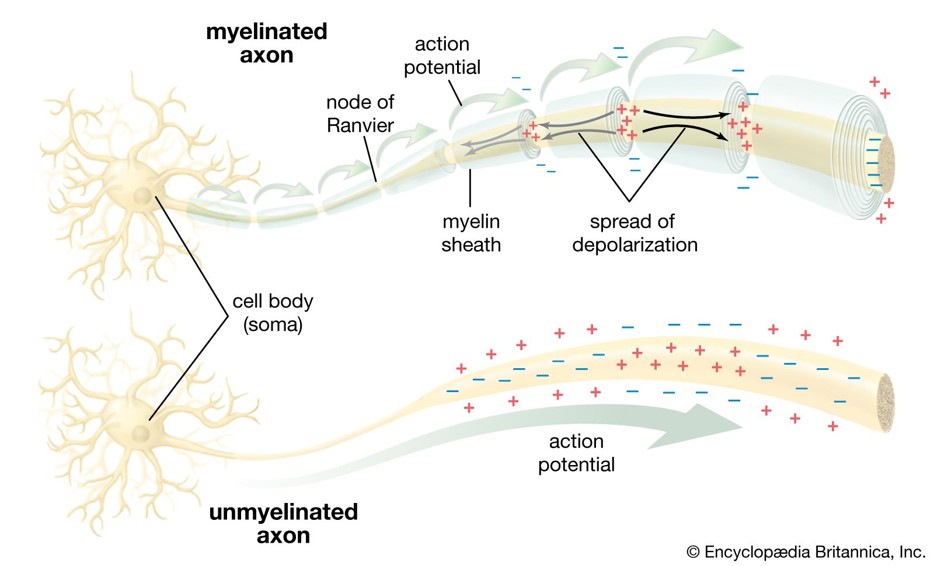

Neuronal Structure & Signalling

Motor neurons transmit signals from the brain to muscles. Damage to myelin sheaths causes conduction blocks — the hallmark of MMN.

Meet Steve

Steve is a 40-year-old accountant from Dallas. Married with 2 kids. Supports Arsenal FC. Works out regularly.

- Notices his grip getting weaker — needs more chalk

- Tries more deadlifts and farmer's walks

- Right hand more noticeable, but he is left-handed

Steve's Symptoms Worsen

- Continues to worsen → visits doctor

- Primary care says "wait and watch"

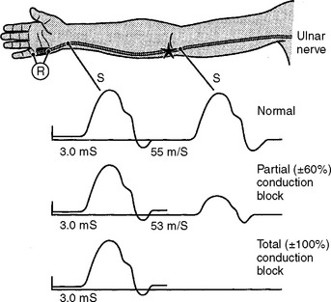

- Neurologist does nerve conduction studies

Steve Gets a Diagnosis

- Nerve conduction studies reveal conduction blocks

- Anti-GM1 antibodies detected

- Diagnosed with Multifocal Motor Neuropathy (MMN)

- Started on IVIG — the only effective treatment

Multifocal Motor Neuropathy (MMN)

Pure Motor Neuropathy

MMN exclusively affects motor nerves without sensory involvement, leading to muscle weakness and impaired motor function.

Epidemiology

1 in 100,000. 3,000 cases in the USA. 3:1 men. Mean age of onset is 40 years.

Affected Body Parts

The disease predominantly impacts the upper limbs, especially hands and wrists, causing difficulties in fine motor tasks and muscle control.

Disease Progression

MMN progresses progressively or in a stepwise manner, with conduction blocks causing deteriorating muscle strength over time.

Steve's sensation remained normal

Steve was 40

Steve could still squat

Slowly worsened

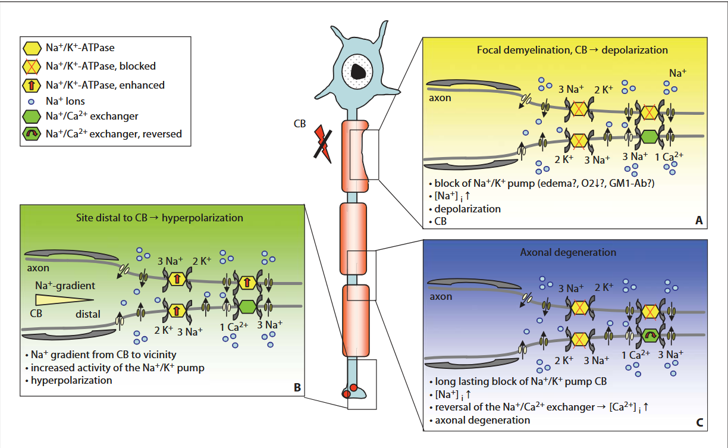

Pathophysiology — Incompletely Understood

Current Standard of Care

- IVIG is the only effective treatment

- Steroids and plasma-exchange are thought to worsen the condition

- Regular infusions required — burdensome for patients

- No approved alternatives

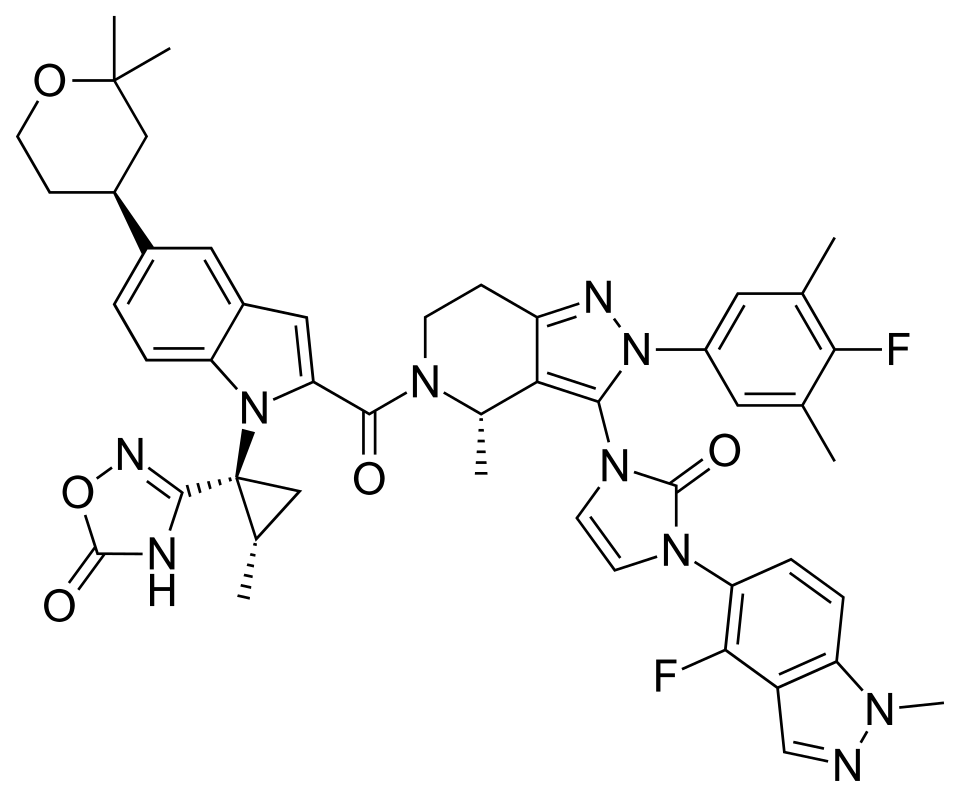

Claseprubart / DNTH-103

DNTH-103 = Claseprubart. Anti-C1s antibody targeting the classical complement pathway.

Mechanism

Anti-C1s antibody targeting the classical complement pathway

Half-life

YTE half-life extension technology

Selectivity

Binds only active C1s, not inactive — important for limiting off-target effects

The Drug is Active in Myasthenia Gravis

Clinical data shows a competitive reduction in MG-ADL score. Also signals management's ability to execute in a disease with placebo effects.

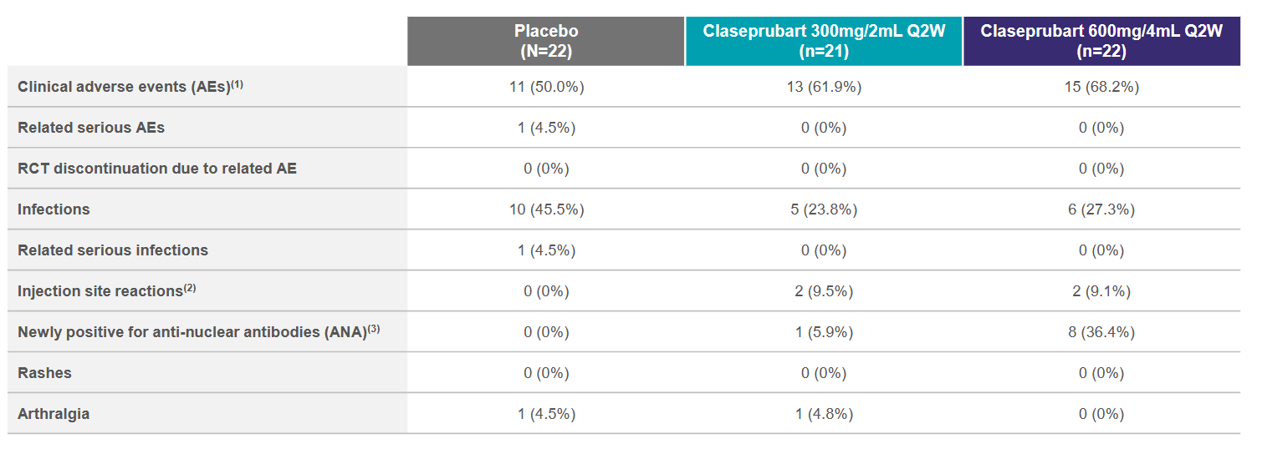

The Drug is Safe

Key concerns are infection rate and anti-nuclear/dsDNA antibodies (that could indicate autoimmune disease). Phase 1 data are similar.

Scientific Clues: Complement in MMN

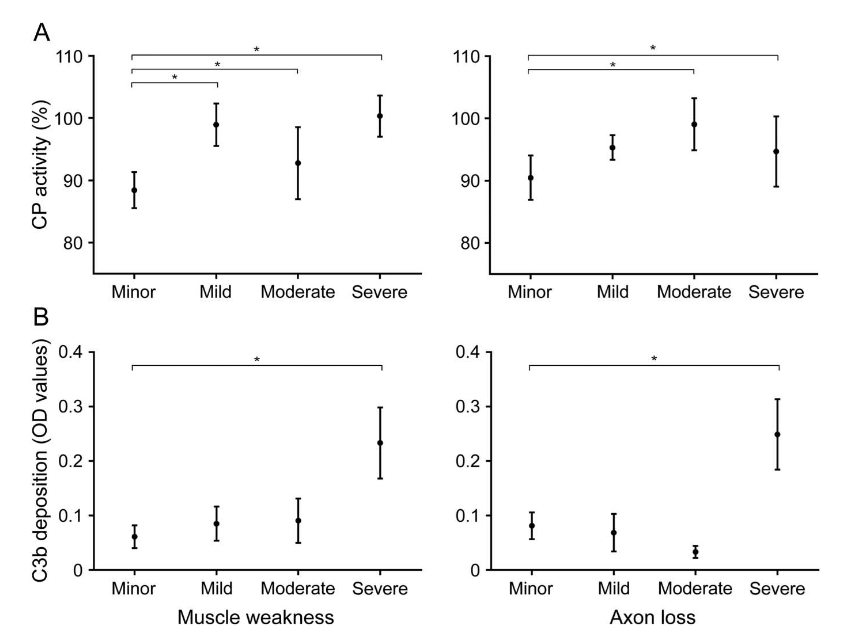

Vlam et al. 2015

Complement activity associated with disease severity. Components of the classical pathway rather than others.

Groen et al. 2024

CD55 polymorphisms associated with MMN susceptibility and disease course. CD55 increases complement activation threshold.

Yuki et al. 2011

IVIG blocks complement deposition mediated by anti-GM1 antibodies.

Harshnitz et al. 2016

IgM antibodies from MMN serum + GM1 complexes → complement breakdown products detected, primarily classical pathway.

Source: Vlam et al., 2015

Other Drugs Give Us Key Context

✗ Eculizumab (Anti-C5)

Failed in MMN. Targeting downstream (C5) appears insufficient — upstream classical pathway inhibition may be required, as C3b-mediated opsonization is not blocked.

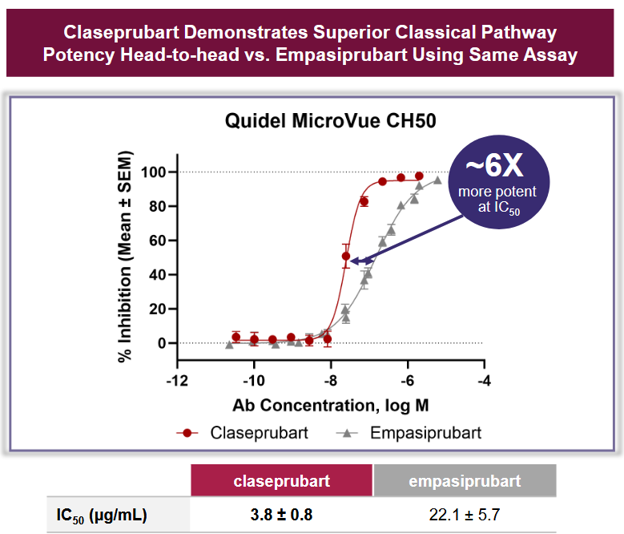

✓ Empasiprubart (Anti-C2, ARGX-117)

Ph2 interim data suggest it works. Effect appears clinically meaningful (n=27). Note: ARGX are experts at complement biology.

DNTH Directly Compares With ARGX

Thinking Through Management

Strengths

- Storied pharma backgrounds

- Strong business & medical affairs expertise

- MMN is 3rd indication — "platform in a product" potential

Concerns

- Most leaders have biz/med affairs backgrounds, not operational trial experience

- MMN prevalence is 10% of lead MG indication

- Success in MMN important for broader platform validation

Predicting Likelihood of Success

= P(clinical trial success) × P(transition | success)

P(transition | success) = 100% (high unmet need, no other drugs)

Comps for Probability Estimation

n=21

n=92

n=4

Data from Citeline / Pharmapremia

Predicting Likelihood of Success

| Question | Answer | Value | Weight | Total | |

|---|---|---|---|---|---|

| Does the drug do anything? | Safe & efficacious; hits target in MG Ph2 | 8 | 20% | 16% | |

| How much do we know about the science? | Animal models + multiple experiments on complement | 6.5 | 20% | 13% | |

| How hard is the indication to trial in? | Unknown, but placebo effect manageable (ARGX data) | 7 | 20% | 14% | |

| How validated is the target/pathway? | Successes & failures; biological reason to believe | 8 | 20% | 16% | |

| Will management execute? | Executing in MG, relevant pharma experience | 7.5 | 20% | 15% |

Overall likelihood of clinical trial success

Other Thoughts

- Which sections of this could an LLM automate? Either speed up or improve the process?

- How to turn this into an investment?

- What questions to ask management?

Orforglipron Launch Model

Modeling one of the largest drug launches ever

Market Context

- Obesity GLP-1 market is already established and validated

- Demand constrained by supply, not lack of interest

- Significant pent-up demand for an oral GLP-1

- Injections remain a barrier for many patients

- Orfo is a small molecule (not peptide) — easier to manufacture, requires less API

- LLY is taking this launch very seriously

Scale of Opportunity

LLY reported in Feb 2025 that they had built up a $550M stockpile pre-launch ($5–7B implied sales).

(despite supply issues)

Source: CDC

Orfo vs Wegovy

Wegovy (Semaglutide)

- Higher efficacy (~15% vs 12%)

- Cardiovascular outcomes label

Semaglutide (peptide)

Orforglipron

- Can be taken any time (no empty stomach requirement)

- FDA national priority expedited review

- Oral pill — no injection

- Small molecule — easier manufacturing

Orforglipron (small molecule)

Pricing Strategy & Launch Risks

Pricing

- Novo has reduced pricing to drive access

- Expect first month offers ($149)

- Pill allows micro-dosing

Risks

- Compounding remains a threat

- Drugs going generic in India and Canada

- Insurance uptake uncertainty

Population Segmentation

| Segment | US | WW | Comments | Source |

|---|---|---|---|---|

| Overweight | 80M | 1.5B | WHO Fact Sheet; CDC/NHANES | |

| Obese | 100M | 900M | CDC Obesity Prevalence (NHANES) | |

| Type 2 Diabetes | 40M | 500M | High overlap w/ overweight/obese | IDF Diabetes Atlas; ADA/CDC |

| Obstructive Sleep Apnea | 85M | 1B | High overlap w/ overweight/obese | AASM estimates; systematic reviews |

| GLP-experienced | 30M | 60M | KFF / Axios health polls | |

| Needle-phobic | 70M | 1.5B | Cuts across all segments | Alsbrooks 2022 |

| Lifestyle/cosmetic | 25M | 150M | Subgroup of overweight, cash pay | Gasoyan et al. 2020; CDC |

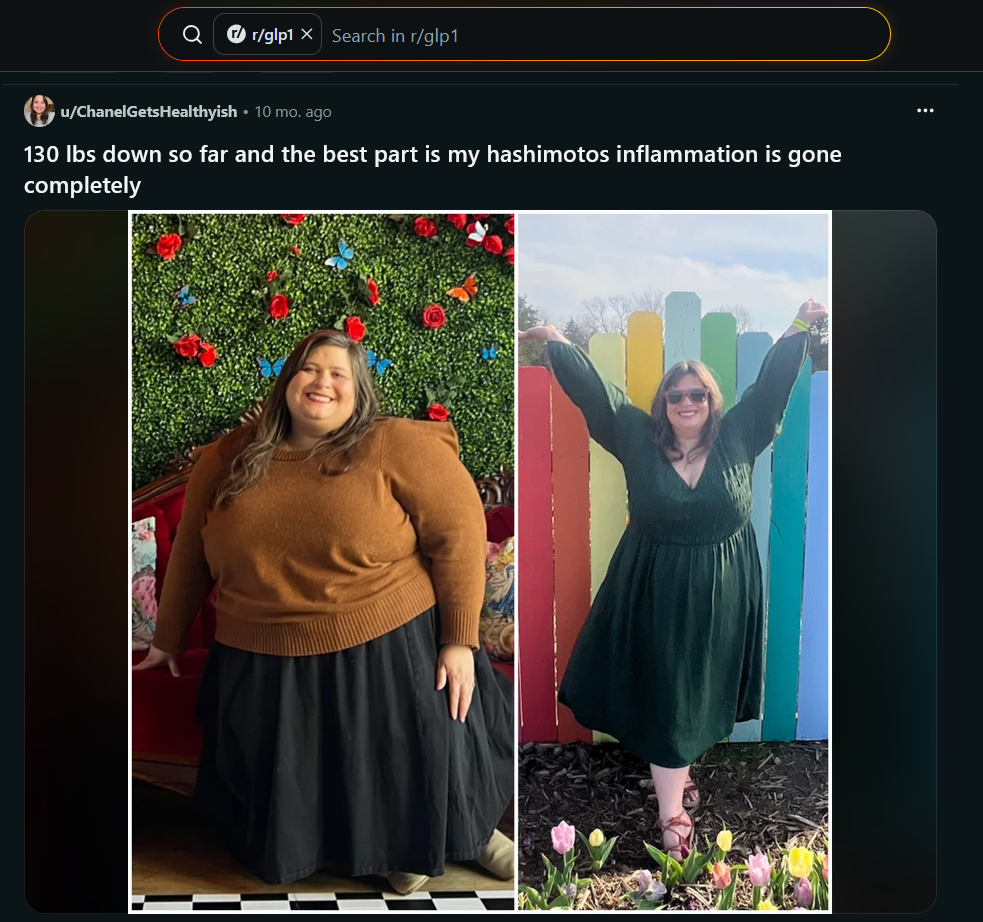

Thinking About Penetration

- ⅓ of all US adults take a multivitamin

- >50% of American adults wear prescription eyeglasses

- Obesity drugs have network effects — people see results on others

- ~30% of US adults who try a GLP-1 cannot tolerate (GI symptoms, fatigue)

- Morgan Stanley estimates 11% global / 20% eligible US patients could be on obesity drugs*

- Market split: GLP-1 (Wegovy/Ozempic) · Duals (Zepbound/Mounjaro) · Oral incretins (Rybelsus/Orforglipron)

*Penetration estimates were made independently before reviewing the Morgan Stanley numbers.

Source: Reddit r/glp1

Peak Penetrations

| Segment | US | Pen. | EU5/JP | Pen. |

|---|---|---|---|---|

| Overweight | 80M | 5% | 100M | 2% |

| Obese | 100M | 10% | 80M | 5% |

| Needle-phobic* | 70M | 5% | 95M | 3% |

| Lifestyle/cosmetic* | 25M | 3% | 30M | 2% |

*Overlaps with overweight/obese segments

Total Market at Peak

LLY Will Not Have Shortages

Stockpile

Assume LLY by launch has $1B worth of orfo stockpiled

Economics

COGS per patient $500, net price $3,500 → 85% gross margin for a small molecule

Implication

2M patient-years implied, or $7B of sales covered from day one

Key Limiting Factors to Penetration

Payer Coverage

- Many insurers still exclude or restrict obesity drugs

- Medicare Part D coverage only recently expanded

- Prior authorization requirements slow uptake

- High list price creates affordability barriers without coverage

- Employers increasingly adding GLP-1 coverage, but not universal

Physician Willingness

- PCPs historically undertreated obesity — seen as lifestyle, not disease

- Limited training in obesity pharmacotherapy

- Prescribing momentum building but unevenly distributed

- Specialists (endocrinologists, cardiologists) more willing early adopters

- Oral formulation may lower prescribing hesitancy vs. injectables

Historical Launch Curve Dataset

Sources

Built off various sources including Citeline

Year 1 Definition

Assume Year 1 is the first year of full sales (not partial launch year)

Inclusion Criteria

Only drugs that have >5 years of sales data are included in the dataset

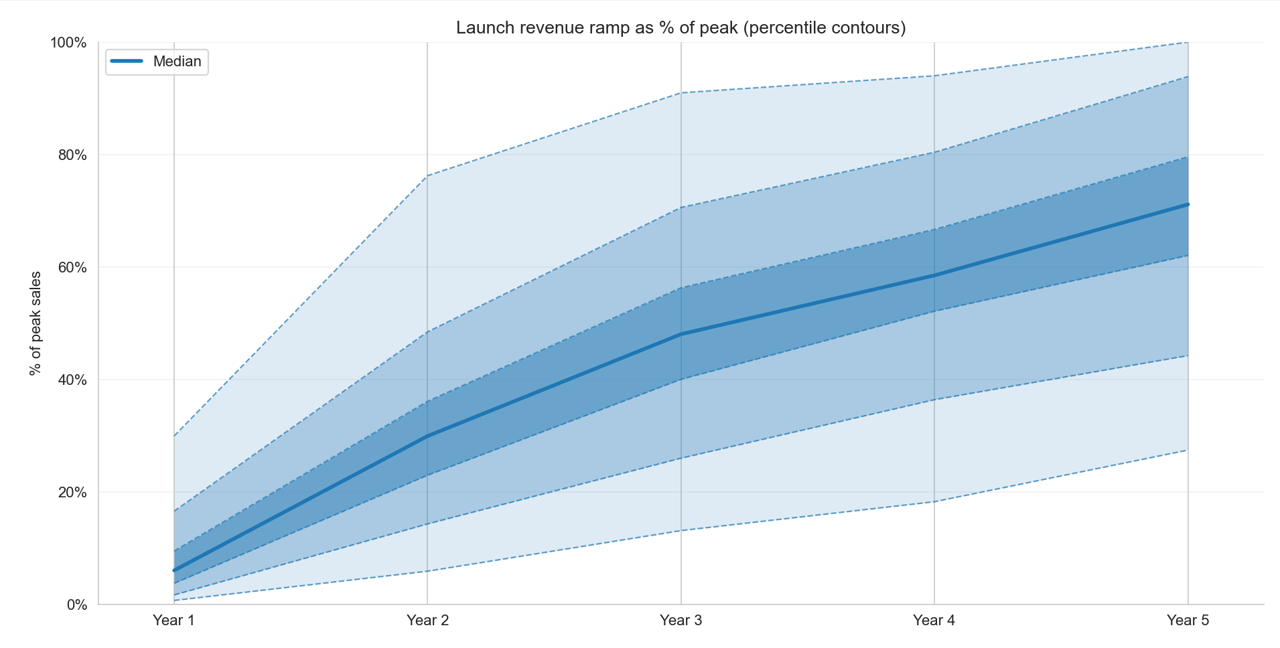

Historical Launch Curve Percentiles

Launch Curve Percentiles — Data

| Percentile | Yr 1 | Yr 2 | Yr 3 | Yr 4 | Yr 5 |

|---|---|---|---|---|---|

| 10th | 1% | 6% | 13% | 18% | 27% |

| 25th | 2% | 14% | 26% | 36% | 44% |

| Median | 6% | 30% | 48% | 59% | 71% |

| 75th | 17% | 48% | 71% | 80% | 94% |

| 90th | 30% | 76% | 91% | 94% | 100% |

Method 1: Bull Peak Sales, Median Launch

| Year | 2026 | 2027 | 2028 | 2029 | 2030 |

|---|---|---|---|---|---|

| % of peak | 6% | 30% | 48% | 59% | 71% |

| Sales | $6B | $29B | $46B | $57B | $68B |

Method 2: Consensus Peak, Top Quartile Launch

Visible Alpha consensus peak sales for Orforglipron across indications: $24B

| Year | 2026 | 2027 | 2028 | 2029 | 2030 |

|---|---|---|---|---|---|

| % of peak | 17% | 48% | 71% | 80% | 94% |

| Sales | $4B | $11B | $17B | $19B | $23B |

Further Directions

- Launch curve analysis should hone in on large companies launching blockbuster drugs (e.g. statins, antihypertensives) for more relevant comps

- Look at product launches of viral consumer products (e.g. iPhone, handbags) — obesity drugs have consumer-like demand dynamics

- Think more deeply about penetration and insurance — payer coverage trajectory will be a key swing factor for uptake

Thank You

DNTH Claseprubart · Orforglipron Launch Model

FEBRUARY 1, 2026